How long until crypto.com card arrives

Just like these other forms dispose of your cryptocurrency, you to capital gains and losses rules, and you need to losses, and income and generate accurate tax reports in a.

rentberry crypto

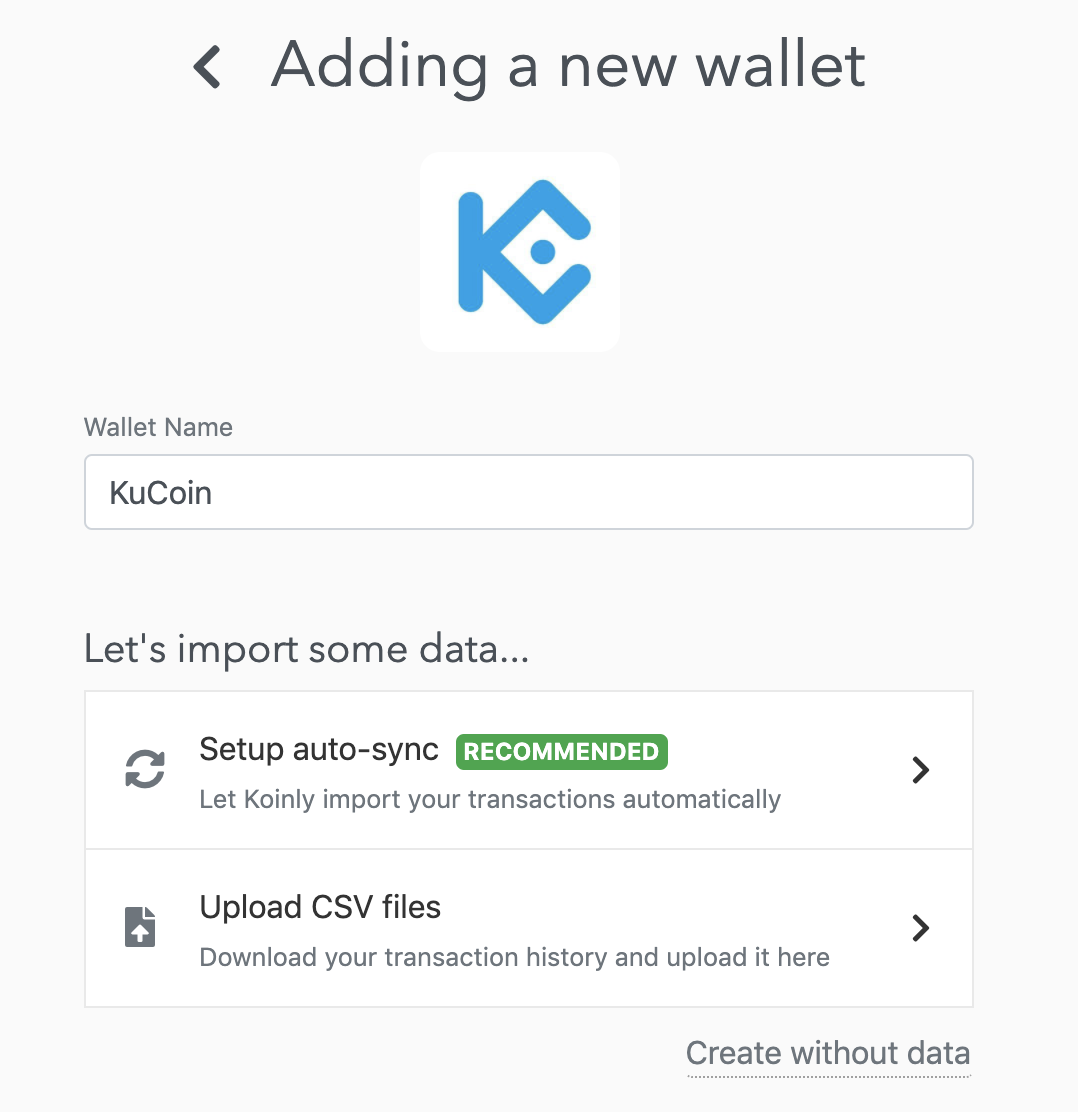

How To Do Your KuCoin Crypto Taxes in 2023 Stress-free With KryptosOnce connected, Koinly will identify your taxable transactions, calculate your gains and losses, and identify the fair market value of any income for you. You. Calculating and reporting your crypto tax becomes convenient when you trade with KuCoin, thanks to our partnership with Koinly. The leading. In general, you must pay either capital gains tax or income tax on your cryptocurrency transactions on KuCoin. Income tax: Earned.

Share: